Publish Date

Apr 17, 2016

Region: North America

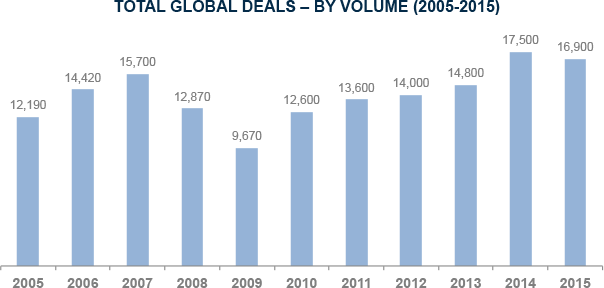

In that 10 year time period, the M&A market has presented both tremendous opportunities and tremendous challenges. Consider this: in the last 10 years, we have seen some of the lowest deal volume in the period, with 9,870 deals completed in 2009, to the highest with 17,500 deals completed in 2014 – or a peak to trough spread of over 75%.

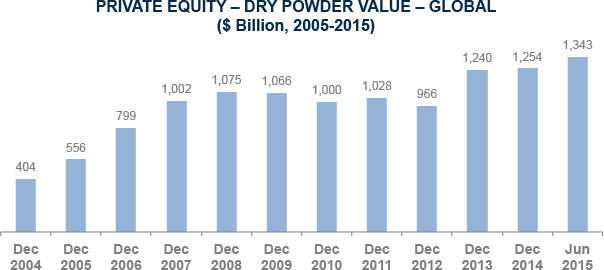

However, what is also borne out by the numbers is this: the amount of money to invest – “or dry powder” – has been on an overall ride up to record highs in the last 10 years: from $404 billion to $1,343 billion in 2015. That is an increase of approximately 230% over a 10 year period. Today there is significant capital to be put to work, and significant work to be done getting portfolio companies ready for sale.

When Alvarez & Marsal launched its Transaction Advisory Group in 2006, it was based on the belief that the firm was uniquely positioned to navigate these volatile global market conditions. Our business has indeed been built on the concept of “counter-cyclicality”. We have created a global, integrated suite of services that delivers value to our clients throughout the volatility of the M&A market these last 10 years. As potential market disruptions continue– election cycles, geo-political issues, and new technologies that can change business models overnight – the A&M Transaction Advisory Group is well equipped to meet the ever changing needs of private equity investors.